What Are the 2025 Prospects for the Greater Paris Real Estate Market?

The Paris region real estate market has experienced pronounced cycles over recent decades, closely tied to macroeconomic conditions.

After the exuberance of the early 2000s—driven by falling interest rates and robust economic growth—the 2008 financial crisis sharply curtailed activity, followed by renewed momentum in the 2010s.

More recently, 2022 saw record transaction volumes, with over 41,000 existing homes sold in Paris—a 20-year high. This surge was fueled by historically low mortgage rates (averaging around 1% in 2021), which significantly boosted purchasing power in an otherwise favorable economic environment.

However, this growth masked early signs of market fatigue: by late 2022, access to credit tightened and household solvency deteriorated amid rising inflation and geopolitical uncertainties.

Past Dynamics and Analytical Frameworks

In 2023–2024, the market experienced a sharp slowdown. Rapid increases in borrowing rates (from about 1% in early 2022 to over 3.5% by the end of 2023) severely dampened demand. Nationally, transaction volumes fell by 21% year-on-year by end-2023, while Greater Paris saw a 36% drop in sales between 2022 and 2024—a decrease of approximately 58,000 transactions in two years in Paris region.

After years of sustained price growth, values began to decline from mid-2023, with a 5% year-on-year decrease in Greater Paris by the end of 2024. Hence, these trends underscore the market’s strong correlation with macroeconomic indicators: low interest rates and growth stimulate activity, while higher credit costs or rising unemployment suppress demand.

For example, over the past 20 years, the steady fall in rates from 5–6% down to 1% facilitated price increases, until the trend reversed in 2022 with the return of inflation.

Analytical Perspectives of the real estate market

❯ The “Friggit tunnel”

Economist Jacques Friggit has long highlighted a “tunnel” relationship between property prices and household income: from 1965 to 2000, this ratio remained stable, but the surge since the early 2000s signals potential overvaluation. The recent drop in volumes and prices in Greater Paris may thus represent a necessary correction after years of disproportionate price growth relative to incomes.

❯ Multi-Factor Models

Analysts such as Michel Baroni (ESSEC) advocate a multi-factor approach, using econometric models that integrate economic variables (interest rates, incomes, rents, etc.) to identify speculative phases and regime shifts.

Recent research suggests the market is entering a new paradigm, where rental dynamics increasingly drive valuations, while financing conditions play a reduced role. In other words, asset values are now more influenced by rental market pressures than by credit conditions alone.

These two frameworks—classic fundamentals versus structural change—lead to contrasting scenarios for the future.

Strategic Scenarios for 2025

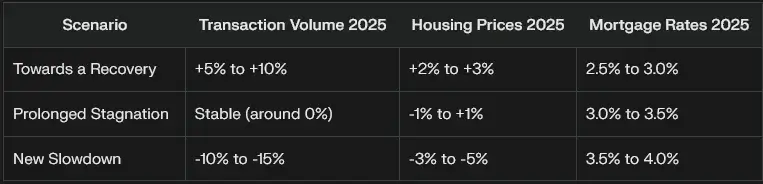

The 2025 outlook for the Greater Paris real estate market remains uncertain, with three main scenarios emerging::

1. Optimistic scenario: Gradual recovery driven by stabilized interest rates and a return of market confidence.

2. Central scenario: Prolonged stagnation, with a wait-and-see attitude prevailing in the market.

3. Pessimistic scenario: Further decline in sales and prices due to a deteriorating economic environment.

The table below summarizes the forecasts associated with each scenario:

Scenario 1: Towards a moderate Recovery

In this optimistic scenario, several factors would converge to revitalize the Paris region real estate market in 2025. First, a more favorable macroeconomic context: inflation would be under control and the European Central Bank would maintain (or even ease) its monetary policy, keeping mortgage rates low, around 2.5% to 3%.

After the shock of 2022–2023, the ECB paused rate hikes. It now anticipates a steady decline in inflation toward 2% by 2025. This monetary stability, along with modest economic growth (~1–1.5%) and falling unemployment, would improve household solvency. It would also help restore confidence in real estate projects.

1. Signs of Recovery

The first signs of such an improvement already appeared at the end of 2024: in Q4 2024, sales volumes in Greater Paris stabilized (down only 2% vs Q4 2023, after much steeper declines previously), thanks to a slight rebound in household solvency (lower prices and higher nominal incomes).

2. 2025 Outlook

As a result, a year-on-year increase in transaction volumes of around +5% to +10% could be anticipated in 2025 in Greater Paris. This growth would remain modest compared to the –13% drop in 2024. However, it would signal that the market has passed its lowest point.

Prices would begin to rise slightly again (+2% to +3%), driven by small Paris apartments and family homes in the outer suburbs. These are the most sought-after segments where latent demand remains strong.

Scenario 2: Prolonged Stagnation

The second scenario foresees a period of sustained flatness in the Greater Paris real estate market. After the shock and correction of 2022–2024, the market would reach a low-activity equilibrium, with neither a real recovery nor a new collapse. Sales volumes and prices would show little movement, reflecting a cautious stance among market participants and a balance of opposing forces.

Economic Context

In this scenario, the macroeconomic environment in 2025 would remain mixed. Interest rates would stabilize around 3–3.5% (a high level compared to the 2010s, but without further significant increases in 2025). Economic activity would be sluggish (growth around 0–1%), maintaining a climate of caution.

Real estate Market Evolution

In practical terms, the Greater Paris real estate market could “tread water” in 2025. Annual transaction volumes would remain close to 2024 levels (with only minor fluctuations, in the range of 0% to +2% or –2%, i.e., within the margin of error).

In this context, prices would also show little change. After the approximately –5% decline seen in 2023–2024, prices might drop slightly further (–1% to –2%) or stabilize (+0%/+1%), depending on micro-market dynamics.

Scenario 3: A New Downturn

The third, more pessimistic scenario envisions that in 2025, the Greater Paris real estate residential market would experience another significant setback, triggered by a sharper-than-expected economic and financial downturn. In this case, macroeconomic indicators would worsen.

For example, a (even moderate) recession in Europe, rising unemployment, or a major confidence shock in the markets. Mortgage rates would climb further, reaching 3.5% to 4.0% on average (clearly surpassing the symbolic 4% mark for 20-year loans in the worst-case scenario).

1. Drop in Transactions

In this downturn scenario, a further drop in transaction volumes of –10% to –15% year-on-year could occur in 2025. After the –13% decline already seen in 2024, this additional decrease would bring activity to its lowest point in decades.

2. Price Decline

At the national level, some expert projections anticipate around an –11% decrease in sales in 2025 and a –6% drop in prices if the crisis persists, with an even sharper impact in Greater Paris given the high price levels reached in recent years.

Paris region market, having surged much faster than household incomes in recent years, is especially vulnerable to a reversal: price declines could reach –5% (or more) over the course of 2025.

Conclusion: Global Factors and Uncertainties

In conclusion, the fate of the Greater Paris real estate market in 2025 will largely depend on the global macroeconomic context. The three projected trajectories—moderate recovery, stagnation, or renewed decline—will materialize based on the prevailing headwinds or tailwinds from the broader environment. As 2025 dawns, several external factors continue to create an uncertain climate:

1. Monetary Policy and the US Dollar

The evolution of monetary policies by major central banks—especially the Fed and ECB—will remain a key determinant for mortgage rates in Europe, and thus for the French market.

2. Deglobalization and Geopolitical Climate

The trend toward global economic fragmentation has accelerated, notably since the US–China trade war in 2018 and subsequent geopolitical crises.

There is a visible retreat in trade between allied blocs, protectionist policies, and the reshoring of supply chains. This creeping “deglobalization” weighs on the confidence of economic actors.

Need Strategic Support for managing Your Real Estate Assets ?

Do you need assistance managing, optimizing, restructuring, or enhancing your real estate portfolio in Greater Paris?

Explore our services or contact us to discover how we can help you maximize the value of your assets.

Written by Alexandre Mérah, Founder of Apis.

References

ADIL 75 – Paris Housing in Figures No. 23 (Dec. 2023) – Data on the Paris real estate market in 2022 (record activity, but deteriorating financing conditions at year-end).

Notaires du Grand Paris – Press Release, February 27, 2025 – “Greater Paris Real Estate Market: 2024 Review and Outlook.” Summary of sales trends (–13% in 2024) and discussion of possible future scenarios (rebound, stagnation, or continued decline).

Notaires de France – Real Estate Market Trends (Feb. 2024) – National indicators on the decline in transaction volumes in 2023 (–21% year-on-year by end 2023, returning to 2013 levels) and decreasing real estate purchasing power.

Amedée-Manesme C.O. & Baroni M. et al. – “A New Paradigm in Paris Real Estate Yield Dynamics,” Revue économique, vol. 71 no. 4, 2020 – Academic study showing that by 2019, rental factors outweighed interest rates in Paris price trends, indicating a shift in traditional market mechanisms.

Meilleurtaux.com – Analysis of Mortgage Rate Trends in 2025 (Feb. 2025) – Historical data on borrowing rates: sharp decline from 2008 to 2021, followed by an increase in 2022. Context for rates at the start of 2025, averaging around 3.3%.

Xerfi / MySweetImmo – “No End to the Crisis Before Late 2025 at Best…” (March 19, 2024) – Scenario analysis of the ongoing real estate crisis: projected decline in sales (–11%) and prices (–6%) by 2025, with a sharper impact in Greater Paris due to excessive price growth relative to incomes.

Mark Sobel – “Trump’s Unsound Dollar Intervention Idea,” OMFIF (July 16, 2019) – Analysis warning that attempts by the Trump administration to weaken the dollar could trigger global financial turbulence. Highlights the interdependence of monetary policies and markets.

Banque de France – Monthly Business Survey (Early Feb. 2025) – Summary of business climate: improvement in early 2025 but persistent high uncertainty. Notes concerns about potential US tariff hikes and the international political environment affecting business confidence.

Banque de France – “Trade War and Geopolitical Fragmentation” (Eco Blog, Feb. 14, 2025) – Overview of rising deglobalization: since 2018, trade has shifted toward allied blocs and declined between rival blocs. Observes the entry into a “new era” of global economic fragmentation and the need for analysts to monitor this trend.

The OpenAI o1 “in-depth research” model was used to draft this article, identifying convergences and divergences among selected sources and ensuring final formatting.